ESG & Responsible Investment Policy

Q4 2022

Introduction

Purpose

This Policy has been established to document the L1 Capital Group’s (‘L1 Group’) approach to Environmental, Social and Corporate Governance (‘ESG’) considerations and Responsible Investment (‘RI’) which includes:

- Responsible investment,

- Active ownership and proxy voting,

- Sustainable environmental impact for the operations of its business, and

- Modern slavery risk.

The Policy was developed for use with consultants, advisors, clients and the public with the aim of providing transparency and documentation of our ESG and RI approach. It has been developed collaboratively by the Chief Investment Officer(s)/Head of Strategy (the ‘CIOs’), the Chief Operating Officer, the Head of Legal & Compliance, the Head of Distribution and the L1 Capital Board.

Roles and responsibilities

Responsibility for the L1 Group’s ESG & RI Policy sits with L1 Capital’s ESG Working Group which comprises of members of the Investment, Operations and Client Services teams. The ESG Working Group meets quarterly to:

- Monitor ESG regulation and developments,

- Manage our obligations as a signatory to the Principles for Responsible Investment (‘PRI’) and as a member of ESG Research Australia (‘ESGRA’), and

- Oversee the sustainability and social impact of L1 Capital’s corporate operations.

The CIOs of each of the L1 Group’s equities investment strategies (the ‘Equities Strategies’) are responsible for overseeing and documenting how this ESG & RI Policy is applied to each Strategy (see individual ‘RI Approach documents’ for each Strategy that are supplementary to this Policy).

The CIOs are responsible for proxy voting for their respective Equities Strategies.

The Head of Legal & Compliance oversees the L1 Group’s Modern Slavery responsibilities.

1. Responsible investment

Commitment

The L1 Group believes that a deeper understanding of ESG issues can help both to increase long-term returns and to better manage risk in our portfolios.

The L1 Group is committed to transparency and is pleased to share its policy on RI. We continue to evolve our investment and corporate disclosures and, as a United Nations Principles for Responsible Investing (‘PRI’) signatory, we comply with the reporting requirements of the PRI. The L1 Group takes its responsibilities as a steward of investors’ capital seriously and uses its influence to maximise overall value for investors.

The L1 Group is committed to being a responsible investor by:

- Incorporating ESG considerations in investment decision-making where they have material impact, and

- Demonstrating good investment stewardship by being active, engaged owners of the companies in which we invest.

Objective

The objective of our RI efforts is to provide a long-term boost to alpha for our portfolios. Given the potential implications that ESG issues have on companies’ capital allocation, operating costs, business risks and, therefore, fair value, we believe that we can achieve this objective through cultivating an understanding of material ESG risks and opportunities as we perform our investment research. We do not set ESG objectives that target specific ESG outcomes.

Application

Each investment team in the L1 Group has the discretion and independence to manage assets according to their own investment philosophies and processes, however we have a common commitment to integrating RI into of the L1 Group’s Equities Strategies. As such, the commonality sets the scope of this RI Policy to include all pooled vehicles and mandates managed within:

- L1 Capital Long Short Strategy,

- L1 Capital Catalyst Strategy; and

- L1 Capital International Strategy.

This RI Policy does not cover the L1 Capital Global Opportunities Fund or the L1 Capital U.K. Property Fund, each of which adopt their own approaches to investing in accordance with their respective asset classes.

This Policy is complementary to documentation around our investment processes. In particular, it should be read in conjunction with the individual RI Approach documents for each Equities Strategy, which detail how the relevant investment teams apply this Policy in their investment processes.

Guiding principles

The L1 Group has adopted four guiding principles for ESG, based on the PRI:

1. We will incorporate ESG issues into investment analysis and decision-making.

- Integrate consideration of ESG issues in our investment process.

- Encourage investment service providers (such as financial analysts, consultants, brokers, research firms, or rating companies) to integrate ESG factors into evolving research and analysis.

2. We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Exercise voting rights or issue recommendations to our clients where required under the mandate.

- Participate in the development of policies and regulations which promote shareholder rights and standard setting (such as promoting and protecting shareholder rights).

- File shareholder resolutions, if warranted, consistent with long-term ESG considerations.

- Engage with companies on ESG issues where appropriate.

3. We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Ask for ESG reporting in annual financial reports.

- Ask for information from companies regarding adoption of/adherence to relevant norms, standards, codes of conduct or international initiatives.

- Support shareholder initiatives and resolutions promoting ESG disclosure.

4. We will report on our activities and progress towards implementing the Principles.

- Disclose how ESG issues are integrated within investment practices.

- Communicate with stakeholders about ESG issues and the Principles.

- Report on progress and/or achievements relating to the Principles.

Definitions of key terms

Responsible Investment (RI): is the integration of material environmental, social and corporate governance considerations (including labour standards and ethical considerations) into investment management processes and ownership practices in the belief that these factors can have a positive impact on financial performance.

ESG considerations: standing for ‘Environmental’, ‘Social’ and ‘Governance’ are non-financial factors that can provide insight into a company’s level of sustainability, which may or may not already be reflected by financial metrics.

- Environmental considerations look at usage of and impact on the natural world and related resources.

- Social considerations examine the treatment of people both inside and outside the company, including labour standards.

- Governance considerations focus on how a company is managed.

Ethical considerations are embedded in the considerations of each of the ESG factors.

Investment stewardship: is the use of influence by institutional investors to maximise overall long-term value including the value of common economic, social and environmental assets, on which returns, and clients’ and beneficiaries’ interests depend.

Approach and style

As fundamental bottom-up investors, the L1 Equities Teams use an internally-developed ESG integration approach, defined as:

- Integration: explicitly including material ESG risks and opportunities into financial analysis and investment decisions based on a consistent process and appropriate research sources.

In practice, our integration approach means:

- ESG has linkages to value creation across our portfolio by sitting alongside fundamental considerations of companies and thereby potentially impacting qualitative and quantitative assessments, the decision whether we invest and at what size.

- We supplement our bottom-up approach with selective top down ESG research, empowering our investment teams to contextualise themes for their sectors, geographies and/or markets using their own, research-driven judgement.

- We augment the capabilities of our core team with external advisers, leveraging our network to access available ESG and RI-specific expertise, however we do not formulate our views based on an externally-developed set of standards or ratings.

- We seek to be active owners of companies, engaging with them and, where appropriate, using the full spectrum of active ownership levers from proxy voting through to activism (in the Catalyst Strategy, particularly) to drive alpha.

In line with our research-intensive fundamental style, each investment team draws on a range of possible ESG approaches defined below. Each team tailors which approach(es) they use according to their unique investment process as well as the business, industry, geography and markets in which the company they are assessing operates. This forms a flexible toolkit that ensures our analysis is meaningful, relevant and targeted to material factors in the research we do:

- Risk/value approach: focuses on understanding the ESG issues a company faces on a case by case basis and considering how these risks may impact the future value of the company in which we invest. In this way, we weigh up the ESG risk associated with the investment against the expected return and decide whether or not the investment meets our ESG requirements.

- Rising stars: considers long-term value creation by seeking to identify companies that have the potential to improve their ESG management significantly over time, often from a low base. By improving their ESG management, the companies are likely to deliver better risk outcomes and potentially generate alpha from ESG.

- Minimum standards: analysis of ESG considerations at the company, sector or geographic level allowing us to exclude from the investment universe potential investments that do not meet a specified threshold, and enhances our ability to apply a set of criteria irrespective of industry or sector.

- Active ownership: uses active company engagement, proxy voting, and public and private shareholder activism, as warranted, to express our views and help unlock shareholder value.

In line with our bottom-up approach, we do not apply screens/filters (either positive or negative) to the overall investment universe for our portfolios, nor do we have a uniform, predetermined view about minimum standards that is applied across all companies indiscriminately. Each Equities Team uses their discretion to determine what ESG factors are relevant and material to each company, industry and/or geography. Similarly, the themes that we develop – which lead us to identify and allocate capital to certain areas, either ESG-related or not – are typically generated from our bottom-up research rather than from the pursuit of top-down perspective.

The high degree of flexibility in our investment approach also enables us to continue to evolve as corporates, community and Government stakeholders, and investors become more aware of and focused on ESG issues, helping us to achieve our aim of continuing to broaden and deepen how we analyse and incorporate ESG considerations over time.

Responsibilities and resources

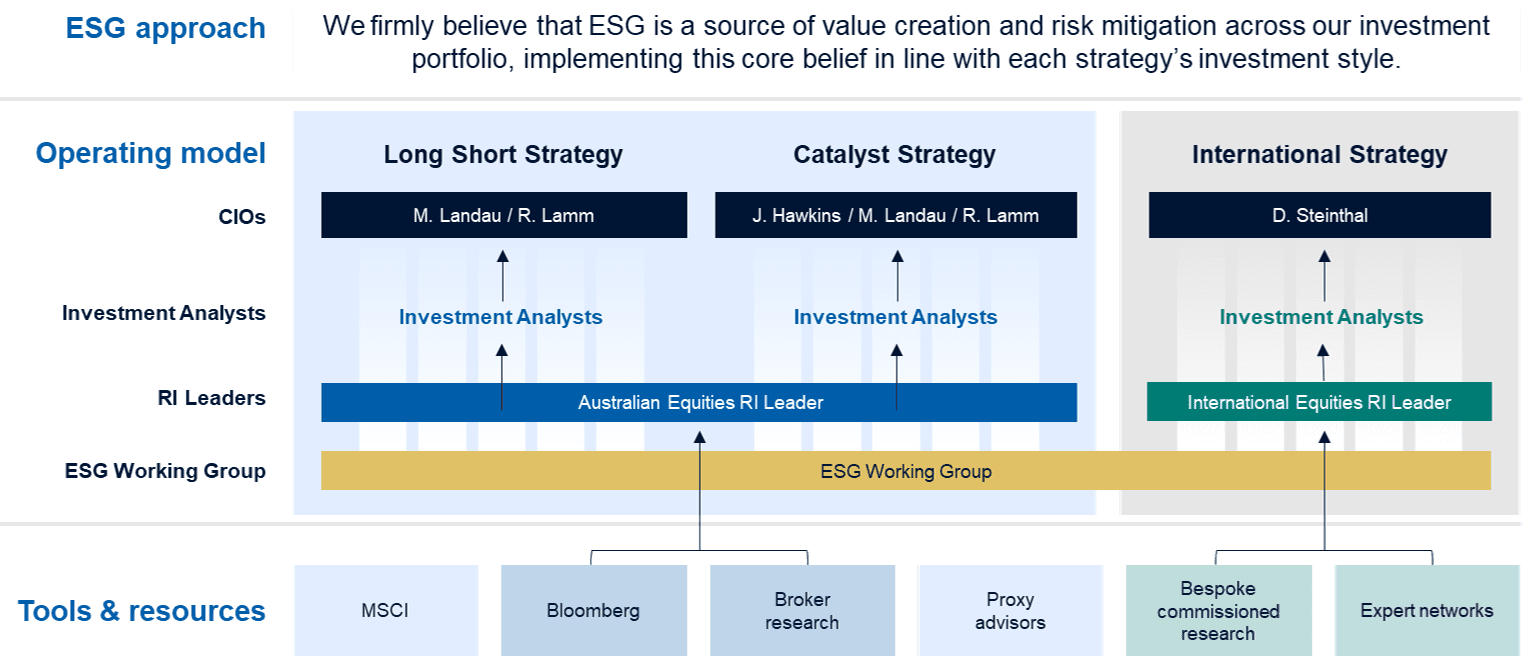

Under our integration approach, all Equities Team members have ESG responsibilities embedded into their research duties, supplemented by team members with specific responsibility for RI leadership, and by tools and information sources. In addition, the ESG Working Group provides the investment teams and company management with broader perspectives and awareness of ESG issues. The below diagram summarises this framework:

Key roles and responsibilities are:

- CIOs: Oversight, accountability and final decision making on portfolio allocation, including integration of ESG and all other factors.

- Investment Analysts: Conduct fundamental, bottom-up research, incorporating ESG factors into analysis alongside fundamental considerations.

- RI Leaders: Overall responsibility for the firm’s ESG framework (internal and external engagement) and for dissemination of thematic, top-down, research for Equities Teams to contextualise.

- ESG Working Group: Stays abreast of any relevant changes in legislation or industry practice and share these updates with the investment team as appropriate.

- Tools and Resources: Generalist, specialist and broker capabilities support the team’s realisation and execution. When selecting and remunerating brokers, we consider the quality and relevance of their ESG research alongside their depth and breadth of corporate access, quality of company/sector and capital markets coverage and their trade and execution abilities.

Oversight, governance and monitoring

Oversight of RI is included in the ongoing, comprehensive investment analysis by the CIOs and their investment teams to ensure internal policies are implemented appropriately and internal checks are monitored. These checks include updates of the frequency of analysis, the sources used and whether they are first principle or third party sourced. The Board of Directors of the L1 Long Short Fund Limited (ASX:LSF) provides additional oversight of the relevant investment process and ensures adherence to investment policy.

Ongoing monitoring for application of the policy is conducted by the L1 Capital Operations & Compliance Committee, who raise any salient issues with the relevant Equities

Team and the Board of the listed vehicle(s), as applicable.

The Group is also held accountable to its RI commitment through its periodic reporting as a signatory to the PRI.

Documentation

‘RI Approach’ documents have been prepared for each Strategy covered by this Policy. These documents set out the RI approach and style for each Strategy and are supplementary to this Policy.

The RI Approach documents are living documents which are regularly reviewed and developed by the CIOs and their investment teams. They are designed to provide transparency on how this Policy is applied to each individual Strategy. Please contact info@L1.com.au to enquire about obtaining these documents.

2. Active ownership and proxy voting

Background

This section applies to all portfolios where the L1 Group provides investment management services and has been delegated voting responsibilities. It sets out the L1 Group’s approach to proxy voting in the context of portfolio management, client service responsibilities and corporate governance principles.

Guiding principles

The L1 Group recognises the strong link between good corporate governance and investment outcomes. We believe good governance provides a long term boost to alpha for the portfolio given the potential implications on capital allocation, operating costs and business risks.

As part of our RI approach, we consider ourselves to be active owners and seek to influence company policy by virtue of shareholdings under our management. We do this in a number of ways, including discussions with company management and the exercise of voting power. We consider that proxy voting rights are an important asset that have the potential to enhance portfolio returns.

We believe that it is our fiduciary responsibility to exercise our vote on all significant matters for companies in which our funds are invested. We also engage the services of proxy advisers.

The L1 Group uses its best efforts to vote proxies, however in some circumstances it may be impractical or not possible to do so.

Proxy voting procedures

The CIOs of each Strategy are ultimately responsible for proxy voting and for determining whether the Strategy will make a proxy vote election on a resolution or whether we will defer to proxy advisers. Proxy votes are cast in a manner that is deemed most likely to protect and enhance the long-term value of the security in the portfolio.

Where the L1 Group has the power and authority to vote, we will vote for or against or, where deemed appropriate, will actively abstain from voting on investments in all holdings. On company-specific matters, the CIOs consult with the Investment Analyst covering the company.

All voting recommendations will be reviewed by the CIOs. Where there is disagreement between Investment Analysts over how a vote should be cast, the ultimate decision rests with the CIOs.

Upon finalisation of proxy vote elections, the custodian of the investment portfolio will be notified and instructed to vote in accordance with the proxy vote election.

Conflicts of interest

L1 Capital’s priority is always our clients’ best interests. At no time will we use our proxy voting power to advance our own commercial interests at the expense of our clients’ interests, or to pursue a cause that is unrelated to our clients’ economic best interests.

The L1 Group will not vote where we are excluded from doing so by the Corporations Act or other laws, or in cases where a conflict of interest cannot be resolved. All conflicts are managed in accordance with L1 Capital’s Conflicts of Interest Policy.

Reporting

Voting records are provided to investors upon request, including the number of company meetings voted.

3. Sustainable environmental impact

The L1 Group is committed to the sustainable environmental impact of its global operations and documents its approach to operating sustainability in its Sustainable Operations Process document which sits in the Employee Handbook. Like the RI Approach documents, the Sustainable Operations Process is a living document which is regularly reviewed and updated by L1 Capital’s operations team.

4. Modern slavery risk

Modern slavery statement

The L1 Group is committed to acting ethically and with integrity in its business dealings and commercial relationships and to implementing and enforcing effective systems and controls to help to ensure that modern slavery is not taking place within its business or supply chains. The L1 Group’s services are provided from its various offices globally. Its directors and employees are subject to a Code of Conduct which sets out high ethical standards for business conduct.

How we assess modern slavery risk

The L1 Group’s primary suppliers include custodians, fund administrators, IT service providers and professional services firms (who typically provide legal, tax, accounting and professional services). The L1 Group has considered its risk profile and that of its primary suppliers. A number of the L1 Group’s large primary suppliers in Australia publish anti-slavery policies and procedures, which the L1 Group has reviewed, and starting in 2020 we have asked about their anti-modern slavery processes as part of our annual service provider due diligence process. With certain smaller suppliers where a higher risk of modern slavery is identified, the L1 Group will consider using contract wording (for example, on right to work status and living wage levels over minimum wage figures) to help ensure compliance. This may be reinforced by enhanced annual due diligence of these suppliers.

Modern slavery register

The L1 Group has a Modern Slavery Register to track any incidents of modern slavery. If the L1 Group becomes aware of an incident of modern slavery, it will not attempt to resolve the situation by itself and will ensure its actions are always in the best interests of the suspected victim/s. The L1 Group will consider if further action is required to verify if modern slavery is occurring and whether and how to involve law enforcement. Any response will be appropriate to the circumstances of the situation.

Document control and review

This Policy is reviewed periodically by the CIOs to ensure the L1 Group’s approach to ESG and RI is documented appropriately. At a minimum, this policy is reviewed on a biennial basis (every 2 years) by the CIOs, Head of Legal & Compliance and the Operations & Compliance Committee in line with the L1 Group’s policy review cycle. Any changes to this Policy are advised to all staff at the time.